This guide will explain what mezzanine finance is and how it works, the possible uses, and the pros and cons. This should help you understand whether it may be suitable to help finance your business.

What is mezzanine finance?

Mezzanine finance is a hybrid form of business funding, combining features of debt (loans) and equity. While it’s more complex than other types of finance, it can be key to a business getting the capital it needs. It’s a higher risk form of debt than traditional loans but it offers higher returns.

Types of Finance

Mezzanine finance sits between debt and equity. It’s likely that you’re already familiar with these types of funding. Here is a summary of their key features:

Debt finance

Debt finance is the term used for most types of borrowing that rank highest in the order of repayment and are most recognisable to us. These include business loans, commercial mortgages, asset finance, working capital facilities (e.g. overdrafts and invoice discounting) and other similar arrangements. Debt finance can either be secured or unsecured, with secured debt being the easiest and cheapest to obtain.

In simple terms, debt finance involves the borrowing of a lump sum, which is then paid back over time, plus an agreed-upon amount of interest.

Equity finance

Equity finance is the term used to describe the process of raising funds by selling shares. Investors provide capital and become shareholders in the business. The value of an investor’s stake in a company fluctuates with the company’s value.

It's possible for an equity investor to lose money as well as to make money. It's therefore a riskier form of financing. Unlike lenders who will only be around for the usual duration of a loan agreement, investors will often be in it for the long-term. They’ll be looking to stay involved with a company for many years and see it grow.

Mezzanine finance

Mezzanine finance falls somewhere in the middle of these. In terms of priority of repayment, it ranks behind senior debt (the debt that is paid back first if the company goes under - often provided by banks) but before common equity (the investments made by common shareholders).

This means that it’s a higher risk form of debt than traditional loans but it offers higher returns - rates are typically within the range of 10% to 20% per year.

In some circumstances, the mezzanine agreement may contain protections that if the business can’t service the debt, the lender can convert the outstanding loan into an equity stake in the company.

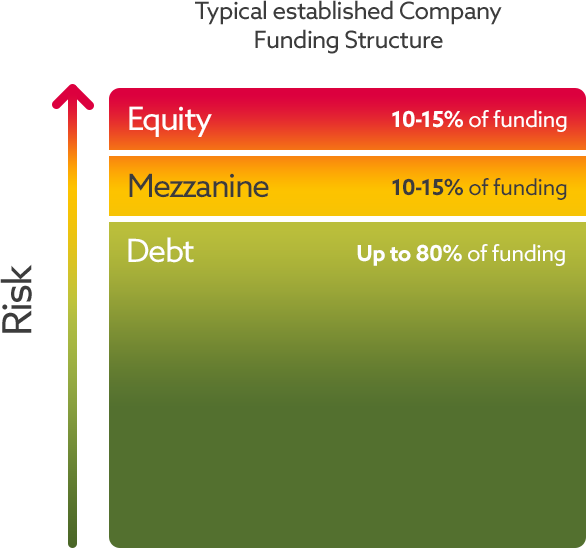

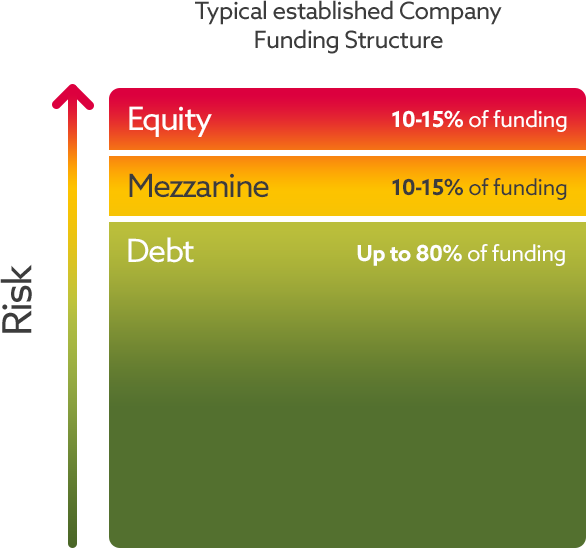

Mezzanine finance can be useful in the funding structure of a company, helping to bridge the gap between debt and equity. The diagram below illustrates how it is commonly used:

A business may not be able to raise enough capital from a bank loan alone, so mezzanine finance can provide the additional capital it needs. It can also allow a business to limit the amount of equity investment required, which is an advantage for those who wish to retain equity control.

How does mezzanine finance work?

This is best explained by a simplified example. Let’s consider a company that is looking for £1,000,000 of funding for a project. They have secured a £700,000 loan from their bank, and the company and/or its shareholders are able to provide a further £150,000 investment towards the project. This leaves a funding gap of £150,000. Once the project is completed in 12 months’ time, the company is forecast to be generating additional income to support/service this amount.

Through a mezzanine finance arrangement the business could secure the £150,000. This facility will rank behind the bank debt and likely be subordinated, but as unsecured facility will command a risk premium interest rate of potentially up to 20%.

It is possible depending on the overall perceived risk that the mezzanine agreement may contain equity conversion rights. This means that if the business suffers a setback and can’t service the facility, the lender could look to get back what they’re owed another way - i.e. by converting the remaining debt into an equity stake in the company which is worth the same amount.

Possible uses of mezzanine finance

Businesses might look to mezzanine finance as a funding option in a number of circumstances, including:

- Management buy-outs

- Financing projects or funding forecast growth

- Acquisitions

- Property development

Pros and cons of mezzanine finance

Pros

- It enables a company to borrow more than it would get from a debt lender alone, and secure the complete funding it needs

- The repayment of principal is often deferred till later in the loan term or at maturity. This means that only interest payments are required during that time, which allows a business to use the increased cash flow to repay other debt or invest in working capital or growth

- Mezzanine finance in general offers flexibility for the borrower and can be tailored to the business’ needs and financial situation. For example, interest can potentially be rolled up into the loan balance, or part paid / part rolled, depending on the business’ cash flow. So if a business can’t make the next scheduled payment of interest, it can delay payment of some or all of the interest till a later time

- It can reduce the equity requirement and protect existing shareholders from seeing their holdings diluted

Cons

- As it’s generally unsecured, subordinated to debt, and often linked to growth or success, mezzanine loans can be four to six times more expensive than a bank loan. Interest rates are in the 10% to 20% per annum range

- Due to the higher risk, mezzanine lenders can take quite a long time to formalise funding. The process will likely include due diligence on the company

- Most mezzanine finance agreements will involve strict security requirements, guarantees and covenants (restrictions on certain financial and operational activities that borrowers must abide by). This can make them unsuitable for smaller businesses

- Some mezzanine agreements may include protections that if the business fails to service its obligations, the lender’s outstanding loans are converted to an equity stake value. In a worst case scenario, this may give the lender a controlling interest in the business

Hopefully this guide to mezzanine finance has provided you with a better understanding of this form of funding. We provide loans, equity investments, and mezzanine finance to businesses based in Wales.